Jacksonville Property Insurance Attorneys

Property Insurance In Jacksonville: Geographic and Climatic Challenges

Low-Lying Areas: Many parts of Jacksonville are low-lying and prone to flooding. Neighborhoods near the St. Johns River and other waterways are particularly vulnerable. Heavy rains and storm surges can quickly lead to significant water damage, increasing the frequency and severity of claims. Flood insurance, often required for properties in these areas, can be costly and difficult to obtain.

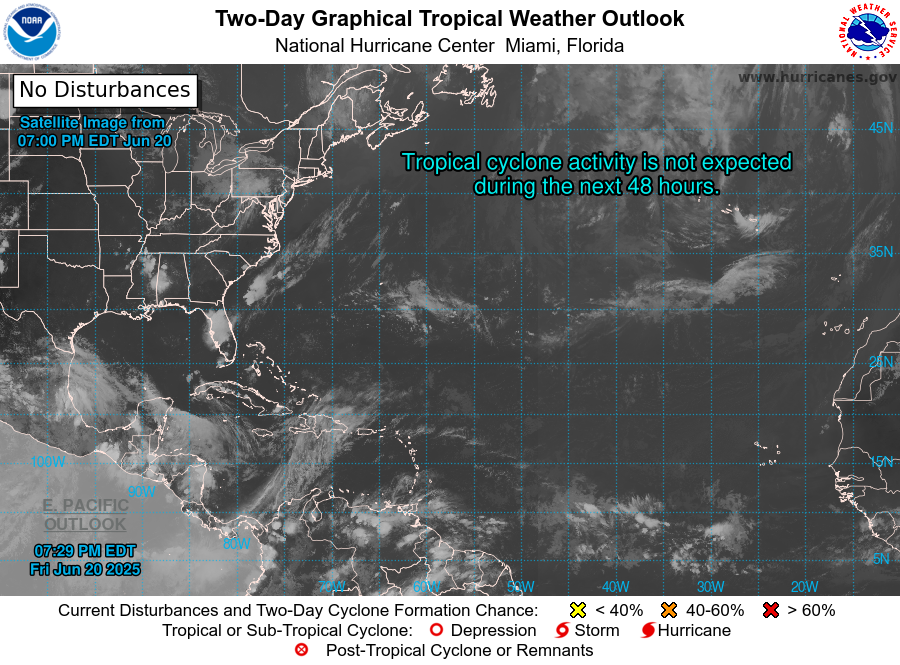

Hurricane Risk: Jacksonville’s position makes it susceptible to hurricanes and tropical storms, which can cause extensive damage to properties. The threat of high winds, heavy rains, and storm surges from these events means that insurers face the potential for large payouts. This risk is often factored into premiums, making insurance more expensive for homeowners.

Property Insurance in Jacksonville, Florida: Navigating Challenges in a High-Risk Area

Property insurance in Jacksonville, Florida, presents unique challenges due to the city’s geography and climate. Jacksonville’s location along the Atlantic coast exposes it to a high risk of hurricanes, flooding, and other severe weather events. This heightened risk significantly impacts both the availability and cost of property insurance in the area.

Insurance Companies’ Reluctance to Pay Out

Due to these risks, insurance companies in Jacksonville are often reluctant to underwrite policies. When they do, they may charge higher premiums or impose stringent coverage terms to mitigate their potential losses. In some cases, insurers may exclude coverage for certain types of damage, such as flooding, unless additional riders or separate policies are purchased.

High Premiums and Deductibles

To manage their risk, insurers often set high premiums and deductibles for properties in high-risk areas. This can make it challenging for homeowners to afford adequate coverage. In some instances, insurance companies may also limit the amount of coverage available, leaving property owners underinsured.

Insurance Bad Faith Risks

The reluctance of insurance companies to pay out on policies they have written compounds the challenges faced by homeowners. In the wake of a disaster, policyholders may find themselves in disputes with their insurers over coverage and claim amounts. This can lead to allegations of insurance bad faith, where an insurer unreasonably denies a claim, delays payment, or fails to investigate a claim properly.

Common Bad Faith Practices

- Unjustified Claim Denials: Insurers may deny claims without a valid reason, forcing policyholders to seek legal recourse to obtain the benefits they are entitled to.

- Delays in Processing Claims: Prolonged investigations and delayed payments can exacerbate the financial strain on homeowners recovering from property damage.

- Inadequate Settlements: Offering settlements that are significantly lower than the cost of repairs or replacement can leave homeowners struggling to rebuild.

Legal Recourse for Homeowners

Property attorneys, like Ross Legal in Jacksonville, play a crucial role in helping homeowners navigate these challenges. They can assist in:

- Reviewing and Interpreting Insurance Policies: Ensuring that homeowners understand their coverage and any exclusions.

- Filing and Negotiating Claims: Advocating on behalf of homeowners to secure fair settlements from insurers.

- Pursuing Bad Faith Claims: Taking legal action against insurers who engage in bad faith practices, seeking compensation for damages and losses.

Conclusion

The combination of Jacksonville’s low-lying areas and high hurricane risk creates a difficult landscape for property insurance. Insurers’ reluctance to pay out on policies can lead to significant financial and legal challenges for homeowners. Engaging with experienced property attorneys is essential to protect their rights and secure the coverage they need to recover from property damage. Ross Legal is well-positioned to assist Jacksonville residents in navigating these complexities and ensuring that they receive fair treatment from their insurers.

Jacksonville Insurance Claims

Live Cam – Jacksonville Beach Pier/Southside

Live Cam – Jacksonville Beach Pier/Northside

Jacksonville Beach, Fl – Live Cam

Jacksonville Beach Pier Florida – Live Cam

Map – Jacksonville, FL

LIVE Weather Resources

Jacksonville Live DOPPLER

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Jacksonville Emergency Sites

- JaxReady – Official emergency preparedness site

- City of Jacksonville Emergency Preparedness Division

- First Coast Relief Fund Emergency Resources

- Duval County Emergency Management

- Florida Division of Emergency Management

- National Hurricane Center

- FEMA Disaster Assistance

- American Red Cross of Northeast Florida

- United Way of Northeast Florida 211

- Jacksonville Fire and Rescue Department

- JEA Outage Center

- Florida Power & Light Outage Map

- Jacksonville Transportation Authority Emergency Info

- Northeast Florida Healthcare Coalition

- Jacksonville Public Libraries Hurricane Guide

- Florida 511 Traffic Information

- National Weather Service Jacksonville

- Jacksonville Sheriff’s Office

- Florida Highway Patrol

- Beaches Emergency Assistance Ministry (BEAM)

- Salvation Army of Northeast Florida

- Catholic Charities Jacksonville

- Jacksonville Humane Society Pet Safety

- Florida Department of Health in Duval County

- Northeast Florida Regional Council

- Florida Small Business Development Center at UNF

- Jacksonville Aviation Authority

- WJXT News4Jax Weather

- First Coast News Weather

- Action News Jax Weather

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Jacksonville Insurance Claim?

Frequently Asked Questions

What should I do if my claim is denied?

Answer: If your claim is denied, carefully review the denial letter to understand the reason. Gather all supporting documents and evidence related to your claim. Contact your insurance company to discuss the denial and request a reconsideration. If necessary, consult with an insurance lawyer to evaluate your options for appealing the decision.

How long does the insurance claim process typically take?

Answer: The duration of the insurance claim process can vary depending on the complexity of the claim and the responsiveness of both parties. Simple claims might be resolved in a few weeks, while more complicated cases can take several months. Staying organized and promptly responding to requests for information can help speed up the process.

Can I choose my own contractor for repairs?

Answer: Yes, you typically have the right to choose your own contractor for repairs. However, it’s advisable to select a licensed and reputable contractor. Inform your insurance company of your choice and ensure that the contractor’s estimates are within the scope of the insurance payout.

What is an insurance adjuster’s role in my claim?

Answer: An insurance adjuster’s role is to assess the damage, evaluate your claim, and determine the amount your insurance company will pay. Adjusters can be employees of the insurance company, independent contractors, or public adjusters hired by you. It’s important to provide them with all necessary documentation and be present during their inspection to address any questions or concerns.

How can I prepare for future insurance claims?

Answer: To prepare for future insurance claims, keep an updated home inventory with descriptions, purchase dates, and values of your belongings. Store important documents, receipts, and photos in a safe place, both physically and digitally. Review your insurance policy regularly to ensure adequate coverage and understand the claims process outlined by your insurer.

What should I do if my insurance company offers a low settlement?

Answer: If your insurance company offers a low settlement, you can negotiate by providing additional documentation that supports the value of your claim. Obtain independent estimates for repairs or replacements and present these to the insurer. If negotiations stall, consider hiring a public adjuster or an insurance lawyer to advocate on your behalf.

How can I expedite my insurance claim?

Answer: To expedite your insurance claim, ensure all required documents and evidence are submitted promptly and accurately. Respond quickly to any requests for additional information from the insurance company. Maintain regular communication with your insurer to stay updated on the status of your claim and address any issues immediately.

What is a public adjuster and when should I hire one?

Answer: A public adjuster is an independent insurance professional hired by the policyholder to assist with the claims process. They assess the damage, prepare claims, and negotiate with the insurance company on your behalf. Consider hiring a public adjuster if your claim is complex, if you disagree with the insurance company’s assessment, or if you want professional assistance to maximize your settlement.

Will filing a claim increase my insurance premiums?

Answer: Filing a claim can potentially increase your insurance premiums, especially if you have a history of frequent claims. The impact on your premium can depend on the type of claim, the amount of the payout, and your insurance company’s policies. It’s a good idea to discuss the potential impact with your insurer before filing a claim.

What is the difference between actual cash value and replacement cost?

Answer: Actual cash value (ACV) is the amount it would cost to repair or replace an item minus depreciation. Replacement cost is the amount it would cost to repair or replace an item without deduction for depreciation. Understanding these terms is important when choosing coverage and filing a claim, as they determine how much you will be reimbursed for damaged or lost items.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998