Fort Lauderdale Property Insurance Attorneys

Property Insurance In Fort Lauderdale: Geographic and Climatic Challenges

Low-Lying Areas and Flood Risk: Fort Lauderdale is situated in a region that is barely above sea level, making it highly susceptible to flooding, especially during storm surges and heavy rainfall associated with hurricanes. This flood risk leads to increased insurance premiums and difficulties in obtaining comprehensive coverage.

High Hurricane Risk: The city’s location along the Atlantic coast makes it a frequent target for hurricanes and tropical storms. The likelihood of significant wind and water damage from these events means that insurance companies face substantial potential payouts. This risk is often reflected in the form of higher deductibles and more stringent policy terms.

Insurance Companies’ Reluctance: Due to the high probability of claims, many insurance companies are reluctant to write new policies in Fort Lauderdale. Those that do offer coverage often include numerous exclusions and conditions, particularly concerning flood and wind damage.

Property Insurance in Fort Lauderdale, Florida: Navigating Challenges in a High-Risk Area

Fort Lauderdale, known for its beautiful beaches and vibrant waterways, is also characterized by its low-lying topography and high hurricane risk. These geographic and climatic factors significantly impact the property insurance landscape in the area.

Insurance Bad Faith in Fort Lauderdale

The challenges of insuring property in Fort Lauderdale are further complicated by instances of insurance bad faith. This occurs when insurance companies fail to act in good faith towards policyholders, often by:

- Delayed Claims Processing: Insurance companies may deliberately slow down the claims process, causing unnecessary stress and financial strain on property owners who need immediate repairs and support.

- Underpayment of Claims: Insurers might undervalue the damage to reduce their payout, leaving property owners with insufficient funds to fully repair and restore their properties.

- Denial of Valid Claims: Some companies may unjustly deny claims altogether, arguing that the damage is not covered under the policy terms, even when it clearly is.

- Excessive Policy Exclusions: Policies might be crafted with numerous exclusions that are not always clearly communicated to the policyholders, leading to disputes and denied claims when damage occurs.

Geographic and Climatic Complications

The unique geography and climate of Fort Lauderdale compound these risks:

- Rising Sea Levels: Climate change and rising sea levels exacerbate the flood risk, making properties more vulnerable over time. This long-term risk can lead to even more stringent insurance terms and higher premiums.

- Frequent Storms: The frequency and intensity of storms in the area mean that the risk of damage is not just theoretical but a near certainty over the lifespan of a property.

- Protecting Policyholders: Given these challenges, it is crucial for property owners in Fort Lauderdale to work with knowledgeable and experienced property attorneys like those at Ross Legal. These attorneys can help navigate the complexities of property insurance, ensuring that policyholders understand their coverage and have robust legal support in the event of a dispute.

Key Services Provided by Ross Legal:

- Policy Review and Analysis: Helping property owners understand the terms and conditions of their insurance policies.

- Claims Assistance: Providing support and advocacy during the claims process to ensure fair treatment and prompt payment.

- Legal Representation in Disputes: Representing policyholders in cases of insurance bad faith, ensuring that their rights are protected and they receive the compensation they are entitled to.

In Fort Lauderdale, where the risks are high and the stakes are even higher, having a trusted legal partner like Ross Legal can make all the difference in securing fair and adequate property insurance coverage.

Conclusion

Dealing with insurance claims, especially after experiencing significant damage from hurricanes or windstorms, can be overwhelming. By understanding your rights, documenting everything thoroughly, and seeking professional help when needed, you can ensure that you receive the fair compensation you deserve. Ross Legal Group is here to support Fort Lauderdale residents in navigating these challenges and fighting for justice in the face of insurance company resistance.

Fort Lauderdale Insurance Claims

In the aftermath of property damage, particularly in high-risk areas like Fort Lauderdale, thorough documentation of your insurance claim is crucial. Proper documentation not only helps in speeding up the claims process but also ensures you receive fair compensation. Here are five essential steps to effectively document your insurance claim:

1. Immediate Damage Assessment and Safety Measures

- Ensure Safety: Before documenting any damage, ensure that the property is safe to enter. If there are hazards such as live wires, gas leaks, or structural instability, wait for professional help.

- Prevent Further Damage: Take temporary measures to prevent additional damage, such as covering broken windows or putting a tarp over a leaking roof. Document these actions with photos and receipts, as they can be reimbursable expenses.

2. Photographic and Video Evidence

- Take Detailed Photos and Videos: Capture comprehensive images and videos of the damage from multiple angles. Include both close-ups and wide shots to provide context.

- Document All Areas: Ensure you cover all affected areas, including the exterior, interior, and any damaged personal property. Don’t forget to document hidden areas such as basements, attics, and crawl spaces.

3. Create an Inventory of Damaged Items

- List All Damaged Items: Make a detailed list of all damaged items, including personal property, appliances, furniture, and structural elements.

- Include Descriptions and Values: For each item, note down its description, original purchase date, and approximate value. If possible, provide receipts or other proof of purchase to substantiate your claims.

4. Keep a Detailed Record of All Communications

- Log All Contacts: Keep a log of all communications with your insurance company, contractors, and any other parties involved. Note the date, time, and summary of each conversation.

- Save All Correspondence: Save emails, letters, and text messages related to your claim. This documentation can help resolve disputes and clarify misunderstandings.

5. Gather Supporting Documents

- Professional Assessments: Obtain written estimates and assessments from licensed contractors or repair professionals. These documents can help substantiate the extent of the damage and the cost of repairs.

- Receipts and Invoices: Keep all receipts and invoices related to temporary repairs, lodging if you’re displaced, and any other expenses incurred due to the damage.

- Insurance Policy Documentation: Have a copy of your insurance policy handy to reference specific coverage details and exclusions.

Final Steps: Submitting Your Claim

Once you have gathered all necessary documentation, submit your claim to your insurance company promptly. Include a detailed cover letter summarizing the damage and referencing the attached documentation. Be proactive in following up with your insurance company to ensure your claim is processed efficiently.

Why Proper Documentation is Critical

- Expedites the Claims Process: Comprehensive evidence helps adjusters quickly assess the damage and process your claim.

- Ensures Fair Compensation: Detailed records support your claim for the full extent of the damage, reducing the likelihood of underpayment.

- Protects Against Denials and Disputes: Clear and thorough documentation provides a strong foundation to challenge any unfair denial or dispute by the insurance company.

Navigating an insurance claim in Fort Lauderdale’s high-risk environment can be challenging, but with meticulous documentation and proactive steps, you can maximize your chances of a favorable outcome. For additional support and expert legal advice, consider consulting with a property attorney like those at Ross Legal. They can guide you through the complexities of the claims process and advocate on your behalf to ensure you receive the compensation you deserve.

Live Cam – Fort Lauderdale Beach

Live Cam – New River South Florida

Elbo Room Beach, Fl – Live Cam

Fort Lauderdale New River, Florida – Live Cam

Map – Ft Lauderdale, FL

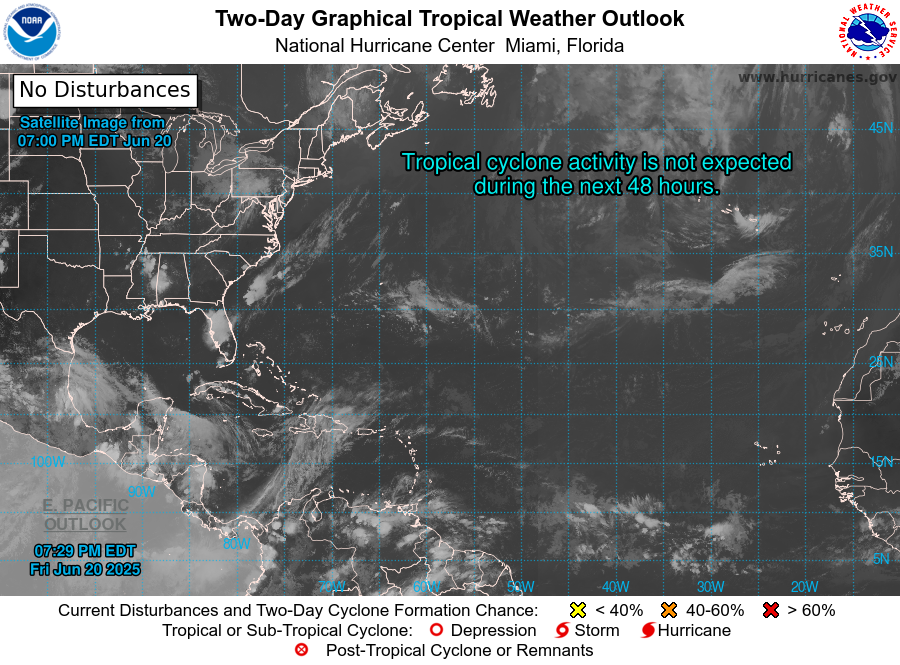

LIVE Weather Resources

Ft Lauderdale Live DOPPLER

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Ft Lauderdale Emergency Sites

- Broward County Emergency Management Division

- City of Fort Lauderdale Emergency Management

- Florida Division of Emergency Management

- American Red Cross South Florida Region

- National Hurricane Center

- Ready.gov Hurricanes

- FEMA

- Weather.gov Hurricanes

- FloridaDisaster.org

- NOAANational Oceanic and Atmospheric Administration

- Broward County Hurricane Preparedness

- Broward County Hurricane Preparedness

- Florida Power & Light Storm Center

- Fort Lauderdale Fire Rescue

- Fort Lauderdale Police Department Emergency Management

- The Weather Channel Hurricane Central

Ft Lauderdale News & Info

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Ft Lauderdale Insurance Claim?

Frequently Asked Questions

What information should I provide when filing an insurance claim?

Answer: When filing a claim, provide your insurance policy number, a detailed description of the damage, photos and videos of the damage, an inventory of damaged items, and any temporary repair receipts.

How long does the insurance claims process take?

Answer: The duration of the claims process varies, but typically, you should receive an initial response from your insurer within 14 days. The complete process can take anywhere from a few weeks to several months, depending on the complexity of the claim and the insurer’s efficiency.

What should I do if my claim is denied?

Answer: If your claim is denied, review the denial letter for specific reasons, compare it with your policy terms, and gather additional evidence to support your claim. Consider consulting with a property attorney to help challenge the denial and negotiate with the insurance company.

Can I make temporary repairs before the insurance adjuster arrives?

Answer: Yes, you should make temporary repairs to prevent further damage, such as covering broken windows or tarping a leaking roof. Document these repairs with photos and keep all receipts, as these expenses can be reimbursable.

What is the role of an insurance adjuster?

Answer: An insurance adjuster evaluates the extent of your property damage and determines the amount of compensation you should receive. They may visit your property to inspect the damage, review your documentation, and negotiate the settlement with you. It’s important to have your own detailed records to ensure a fair assessment.

How can I prepare for potential hurricane damage in advance?

Answer: To prepare for potential hurricane damage, create an inventory of your property and personal items, take photos and videos of your home’s current condition, review your insurance policy to understand your coverage, and ensure you have adequate hurricane protection such as storm shutters and an emergency plan.

What should I expect during the insurance claim inspection?

Answer: During the inspection, the insurance adjuster will assess the damage to your property. Be prepared to walk them through all affected areas, provide your documentation (photos, videos, and inventory), and answer any questions about the damage. It’s helpful to take notes during the inspection for your records.

Can my insurance company cancel my policy after a claim?

Answer: Yes, an insurance company can cancel your policy after a claim, but they must provide a valid reason and follow state regulations, including giving you sufficient notice. Reasons for cancellation may include a high number of claims or increased risk due to extensive damage.

What are the common exclusions in a property insurance policy?

Answer: Common exclusions in property insurance policies include flood damage (which typically requires a separate flood insurance policy), earthquake damage, wear and tear, intentional damage, and certain types of water damage (such as from a slow leak).

How can I speed up the insurance claim process?

Answer: To speed up the claim process, report the damage to your insurer as soon as possible, provide thorough and accurate documentation, respond promptly to any requests for additional information, and follow up regularly with your insurance company to check the status of your claim.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236