Miami Property Insurance Attorneys

Property Insurance In Miami: Geographic and Climatic Challenges

Low-Lying Areas: Miami is characterized by its low elevation and proximity to the sea, which makes it particularly susceptible to flooding. Areas such as Downtown Miami, Miami Beach, and Little Havana often face higher risks of water damage during heavy rains and hurricanes. This geographical reality makes property insurance more expensive and harder to obtain.

High Hurricane Risk: Miami’s location in Hurricane Alley subjects it to frequent and severe storms. The hurricane season, which lasts from June to November, brings the threat of high winds, heavy rains, and storm surges. These conditions can cause significant damage to properties, leading to increased insurance claims.

Property Insurance in Miami, Florida: Navigating Challenges in a High-Risk Area

Miami, Florida, is known for its beautiful beaches, vibrant culture, and diverse neighborhoods. However, it also faces significant challenges due to its geography and climate. Low-lying areas and a high risk of hurricanes make property insurance in Miami particularly complex. Insurance companies often show reluctance in paying out on the policies they have written, increasing the risks of insurance bad faith. Understanding these challenges is essential for Miami residents to protect their properties and ensure fair treatment from insurance providers.

Reluctance of Insurance Companies

- High Costs of Claims: The frequent and severe weather events in Miami result in a high number of claims. Insurance companies often face substantial payouts following hurricanes and floods, making them more cautious about issuing new policies and more stringent in assessing claims. This caution can lead to delays, underpayment, or denial of valid claims.

- Strict Policy Terms: To mitigate their risks, insurance companies may impose strict terms and exclusions in their policies. Homeowners might find that certain types of damage, especially those related to flooding, are not covered unless they purchase additional, often expensive, coverage.

Insurance Bad Faith Risks

- Denial of Valid Claims: Insurance bad faith occurs when an insurance company unreasonably denies a valid claim. In Miami, the risk of bad faith is compounded by the high number of claims and the significant potential payouts. Insurers may deny claims on technicalities or argue that the damage was due to pre-existing conditions rather than the covered event.

- Delayed Payments: Even when claims are approved, insurance companies may delay payments. These delays can be detrimental to homeowners needing immediate funds to repair and restore their properties after a disaster. Prolonged delays can exacerbate the damage and increase repair costs.

- Underpayment of Claims: Insurers might also undervalue the damage to minimize payouts. Homeowners may receive less compensation than needed to cover repair costs, leaving them financially strained. This practice is particularly problematic in Miami, where repair costs can be high due to the extent of the damage from hurricanes and flooding.

Protecting Your Rights

Understanding Your Policy

- Read and Comprehend: Thoroughly read your insurance policy to understand the coverage, exclusions, and your responsibilities as a policyholder.

- Ask Questions: Don’t hesitate to ask your insurance agent to clarify any terms or conditions you don’t understand.

Documenting Everything

- Evidence Collection: Before and after a storm, take detailed photographs and videos of your property. This documentation will be crucial in supporting your claim.

- Keep Records: Maintain a record of all communication with your insurance company, including emails, letters, and notes from phone calls.

Seeking Professional Assistance

- Hire an Insurance Lawyer: If you face difficulties with your insurance company, consider hiring a property insurance lawyer. They can help you navigate the claims process, negotiate with the insurer, and represent you in case of disputes.

- Public Adjusters: These professionals can provide an independent assessment of the damage and help you file a more accurate claim.

Conclusion

Navigating property insurance in Miami, Florida, can be challenging due to the area’s geographic and climatic risks. Insurance companies’ reluctance to pay out on policies and the potential for insurance bad faith make it essential for homeowners to be vigilant. By understanding your policy, documenting everything meticulously, and seeking professional help when needed, you can protect your rights and ensure fair treatment from your insurance provider.

For more information or to schedule a consultation with a property insurance lawyer, contact Ross Legal Group today. We’re dedicated to helping Miami residents secure the compensation they deserve and navigate the complexities of property insurance in this unique and challenging environment.

Miami Insurance Claims

Documenting an insurance claim effectively can make a significant difference in the speed and success of your claim process. Here are five steps to documenting your insurance claim:

1. Immediately Report the Incident

- Contact your insurance company as soon as the incident occurs. Provide a detailed account of the event, including the date, time, and nature of the incident.

2. Take Detailed Photographs and Videos

- Capture high-quality images and videos of the damage from multiple angles. Include wide shots for context and close-ups to show specific damage. Time-stamp these if possible.

3. Keep a Written Record

- Write down everything related to the incident and the claim. This includes the timeline of events, conversations with your insurer, and any expenses incurred. Note down the names and positions of the people you speak with.

4. Collect Supporting Documents

- Gather all relevant documents such as receipts, repair estimates, and police reports. These documents will serve as evidence to support your claim and validate the extent of the damage.

5. Maintain Communication Logs

- Keep detailed records of all interactions with your insurance company. This includes emails, letters, and notes from phone calls. Document the date, time, and summary of each conversation.

By following these steps, you can ensure that you have a thorough and well-documented insurance claim, which can help expedite the process and improve your chances of a successful resolution.

Live Cam – Port Miami Cruise Ship Departures

Live Cam – LIVE Port Miami | Classic View

Coral City Camera (Miami’s Underwater Livestream) – Live Cam

Deerfield Beach Florida – Live Cam

Map – Miami, FL

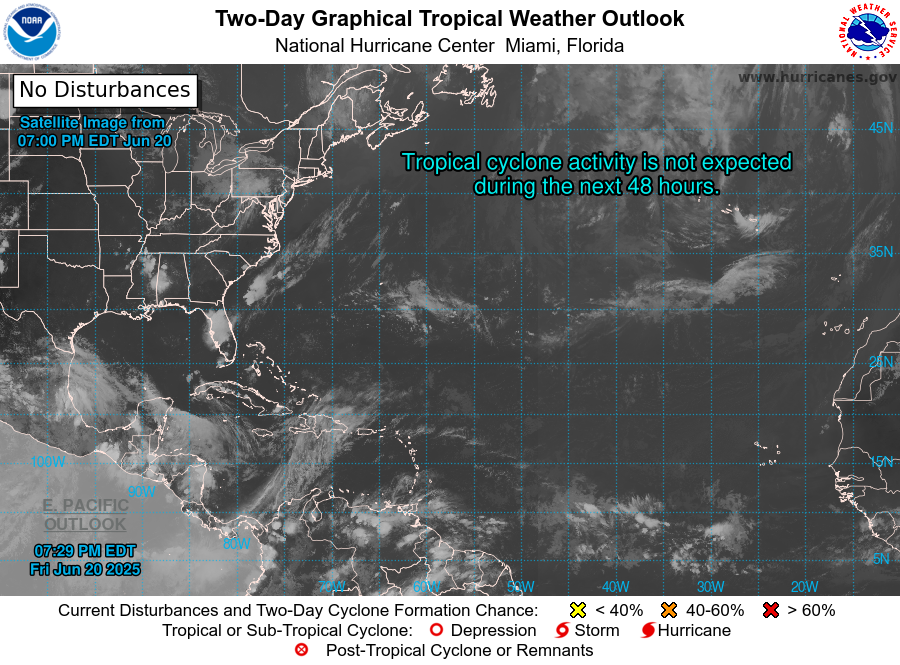

LIVE Weather Resources

Miami Live DOPPLER

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Miami Emergency Sites

- Miami-Dade County Hurricane Readiness Guide

- City of Miami Hurricane Resources

- National Hurricane Center

- FIU Storm Surge Simulator

- Ready South Florida

- Florida Division of Emergency Management

- FEMA Disaster Assistance

- Miami-Dade County Emergency Management

- Florida Power & Light (FPL) – Power Outage Reporting

- Miami-Dade County Disaster Assistance (311)

- Miami Foundation Disaster Resilience Fund

- Miami-Dade County Hurricane Recovery Information

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Miami Insurance Claim?

Frequently Asked Questions

What information do I need to provide when filing an insurance claim?

Answer: You need to provide your policy number, the date and time of the incident, a detailed description of the damage, and any supporting documents such as photos, videos, and repair estimates.

How long does the insurance claim process take?

Answer: The timeline varies depending on the complexity of the claim and the responsiveness of the insurance company. It can take anywhere from a few weeks to several months.

Can I still file a claim if I don’t have receipts for damaged items?

Answer: Yes, you can still file a claim. Photographs, videos, and any other proof of ownership or value of the damaged items can help support your claim.

What are my options if my insurance claim is denied?

Answer: If your claim is denied, you can request a detailed explanation from your insurer, appeal the decision, gather additional evidence, or consult with an insurance lawyer to explore further action.

Is there a deadline for filing an insurance claim?

Answer: Yes, most insurance policies have a specific time frame within which you must file a claim. Check your policy for the exact deadline, and it’s advisable to file as soon as possible after the incident.

What steps should I take if my home is uninhabitable after a disaster?

Answer: Notify your insurance company immediately and inquire about additional living expenses (ALE) coverage. Save all receipts for temporary housing, food, and other necessary expenses.

How can I speed up the claims process?

Answer: Provide thorough documentation, respond promptly to any requests from your insurance company, and follow up regularly on the status of your claim.

What should I do if I disagree with the insurance adjuster’s estimate?

Answer: You can request a re-evaluation, provide additional documentation to support your claim, or hire an independent public adjuster to conduct a separate assessment.

Are temporary repairs covered by my insurance?

Answer: Most policies cover the cost of temporary repairs to prevent further damage. Keep all receipts and document the repairs with photos to submit with your claim.

Can my insurance company cancel my policy after I file a claim?

Answer: Insurance companies cannot cancel your policy solely because you filed a claim. However, multiple claims within a short period may lead to higher premiums or non-renewal at the end of the policy term.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998