Naples Property Insurance Attorneys

Property Insurance In Naples: Geographic and Climatic Challenges

Low-Lying Areas: Much of Naples is situated in low-lying areas, making properties highly susceptible to flooding. Even minor storms can cause significant water damage, and during hurricane season, the risk of severe flooding escalates dramatically. This vulnerability makes it challenging for property owners to secure affordable insurance.

High Hurricane Risk: Naples is located in a region that frequently experiences hurricanes and tropical storms. These powerful weather events can cause catastrophic damage to homes and infrastructure, leading to substantial insurance claims. The high risk of hurricanes increases insurance premiums and often results in more restrictive policy terms.

Property Insurance in Naples, Florida: Navigating Challenges in a High-Risk Area

Naples, Florida, is renowned for its beautiful coastal scenery, upscale neighborhoods, and luxurious real estate. However, the region’s unique geography and climate present significant challenges when it comes to property insurance. The combination of low-lying areas and high hurricane risk makes insuring property in Naples both difficult and expensive. Additionally, insurance companies‘ reluctance to pay out on the policies they have written often results in situations of insurance bad faith, leaving policyholders in vulnerable positions.

Insurance Companies’ Reluctance to Pay Out

The high risk associated with insuring property in Naples leads many insurance companies to adopt stringent measures to protect their financial interests. This can manifest in several ways:

- High Premiums and Deductibles: To mitigate their risk, insurance companies often charge high premiums and impose substantial deductibles on policies for properties in high-risk areas like Naples. While this makes insurance available, it also makes it less affordable for many homeowners.

- Restrictive Policy Terms: Insurance policies for properties in Naples may include numerous exclusions and limitations. For instance, coverage for wind and flood damage might be limited or excluded entirely, requiring homeowners to purchase separate policies.

- Claims Denial and Underpayment: Insurance companies may be more inclined to deny claims or offer settlements that do not fully cover the cost of repairs. This reluctance can stem from the desire to minimize payouts in a high-risk area, leading to disputes between homeowners and insurers.

Insurance Bad Faith in Naples

Insurance bad faith occurs when an insurance company fails to uphold its obligations under the policy, acting in a manner that is unfair or deceptive. In Naples, the risks of insurance bad faith are compounded by the region’s geography and climate. Common bad faith practices include:

- Unjust Denial of Claims: Insurers may deny legitimate claims, arguing that the damage is not covered under the policy terms. This can be especially problematic for homeowners dealing with hurricane and flood damage.

- Delaying Claim Payments: Insurance companies might delay the processing and payment of claims, leaving homeowners without the funds needed to repair or rebuild their properties promptly.

- Underpayment of Claims: Insurers may offer settlements that are significantly lower than the actual cost of repairs. Homeowners then face the burden of covering the shortfall out of pocket.

Protecting Your Rights

To protect your rights as a property owner in Naples, it is crucial to:

- Understand Your Policy: Ensure you thoroughly understand the terms and conditions of your insurance policy. Be aware of any exclusions, limitations, and requirements.

- Document Everything: Keep detailed records of all communications with your insurance company, as well as documentation of any damage and repair costs. This evidence can be crucial if you need to challenge a denied or underpaid claim.

- Seek Legal Assistance: If you believe your insurance company is acting in bad faith, consult with an experienced property insurance attorney. Legal experts can help you navigate the claims process, negotiate with insurers, and take legal action if necessary.

Ross Legal: Your Advocate in Insurance Disputes

At Ross Legal, we understand the unique challenges that property owners in Naples face. Our experienced attorneys specialize in insurance law and are dedicated to protecting policyholders’ rights. Whether you are dealing with a denied claim, underpayment, or any other insurance dispute, we are here to help you secure the compensation you deserve. Contact us today to discuss your case and learn how we can assist you in navigating the complexities of property insurance in Naples, Florida.

Naples Insurance Claims

Navigating an insurance claim can be a daunting process, especially in a high-risk area like Naples, Florida. Proper documentation is crucial to ensure that your claim is processed efficiently and fairly. Here are five essential steps to documenting your insurance claim:

1. Assess and Document the Damage Immediately

- Safety First: Ensure that you and your family are safe before assessing any damage. If necessary, wait for authorities to declare the area safe.

- Photographs and Videos: Take clear, comprehensive photos and videos of all damage to your property. Capture multiple angles and wide shots, as well as close-ups of specific damages.

- Written Description: Create a detailed written account of the damage. Note the date and time of the event, the extent of the damage, and any immediate actions taken to mitigate further loss.

2. Gather Supporting Documentation

- Property Inventory: Compile a list of damaged items, including their descriptions, purchase dates, and estimated values. If possible, provide receipts or proof of purchase.

- Maintenance Records: Provide records of regular maintenance and repairs to demonstrate that the property was well-maintained before the damage occurred.

- Insurance Policy: Keep a copy of your insurance policy handy to understand your coverage and any specific requirements for filing a claim.

3. Communicate with Your Insurance Company

- Prompt Notification: Notify your insurance company as soon as possible about the damage and your intent to file a claim.

- Document Communications: Keep a log of all communications with your insurance company, including the date, time, and names of representatives you speak with. Save copies of any written correspondence, including emails and letters.

4. Mitigate Further Damage

- Temporary Repairs: Take reasonable steps to prevent further damage to your property. This might include covering broken windows or tarping a damaged roof.

- Keep Receipts: Save receipts for any expenses incurred for temporary repairs, as these may be reimbursable under your policy.

- Do Not Dispose of Damaged Items: Keep damaged items until your insurance adjuster has had a chance to inspect them, unless they pose a health hazard.

5. Work with an Insurance Adjuster

- Inspection Appointment: Schedule an appointment with the insurance adjuster to inspect the damage. Ensure that you are present during the inspection to point out all areas of concern.

- Provide Documentation: Give the adjuster copies of all your documentation, including photos, videos, lists of damaged items, and any repair estimates you have obtained.

- Follow Up: After the inspection, follow up with the adjuster and your insurance company to stay informed about the status of your claim. Keep detailed notes of all follow-up communications.

Properly documenting your insurance claim is essential to ensure a smooth and fair claims process. By following these five steps, you can help ensure that you receive the compensation you deserve for your losses. If you encounter any difficulties or feel that your claim is being unjustly denied or underpaid, consider seeking legal assistance from experienced insurance attorneys like those at Ross Legal. We are here to help you navigate the complexities of property insurance claims and protect your rights. Contact us today for expert guidance and support.

Naples Beach, Florida

Via Miramar Beach – Naples Beach, FL

Acceso Naples Beach, FL

Naples, Florida

Map – Naples, FL

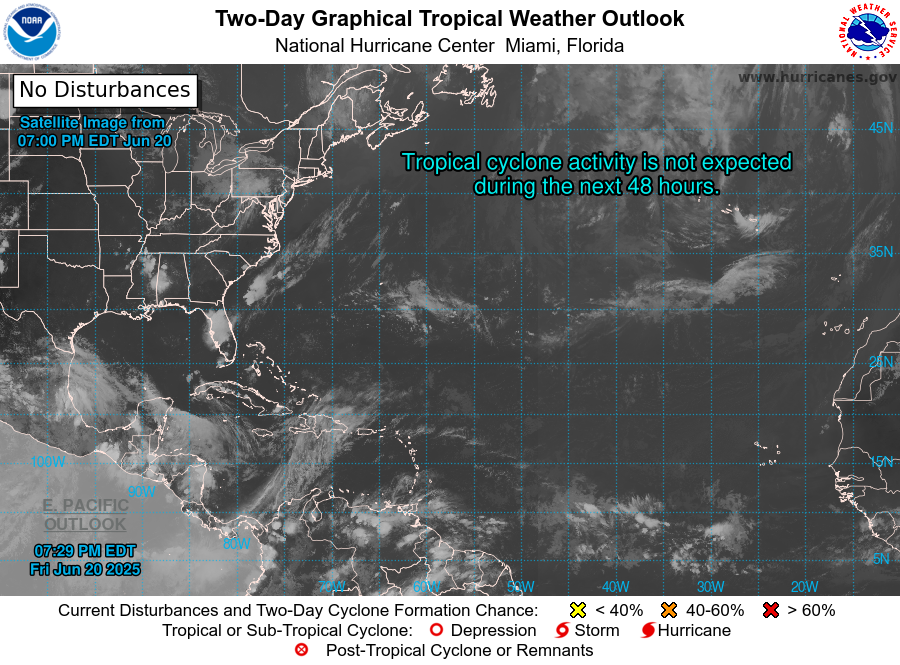

LIVE Weather Resources

Naples Live DOPPLER

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Naples Emergency Sites

- City of Naples Emergency Management

- Collier County Emergency Management

- Florida Division of Emergency Management

- National Hurricane Center

- Ready.gov Hurricanes

- American Red Cross South Florida Region

- Naples Daily NewsHurricane Coverage

- Weather UndergroundNaples, FL

- AccuWeatherNaples, FL Hurricane Information

- Hurricane Preparedness and Response (CDC)

- Naples Fire-Rescue Department

- Naples Community HospitalEmergency Preparedness

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Naples Insurance Claim?

Frequently Asked Questions

What is the timeframe for filing an insurance claim after hurricane damage?

Answer: The timeframe for filing an insurance claim can vary depending on your policy and the insurance company’s requirements. Generally, it is best to file your claim as soon as possible after the damage occurs. Check your policy for specific deadlines and ensure you adhere to them to avoid any potential issues with your claim.

What should I include in my insurance claim documentation?

Answer: Include detailed photographs and videos of the damage, a written description of the events and extent of the damage, an inventory of damaged items with their values, receipts for any temporary repairs, and any correspondence with your insurance company. The more thorough your documentation, the stronger your claim will be.

Can I make repairs before the insurance adjuster inspects the damage?

Answer: You should make temporary repairs to prevent further damage to your property. Document these repairs with photos and keep all receipts for materials and labor, as these costs may be reimbursable. However, avoid making permanent repairs until the insurance adjuster has inspected the damage, unless it’s necessary for safety reasons.

What are common reasons for insurance claim denials?

Answer: Common reasons for claim denials include lack of coverage for the type of damage, failure to file the claim within the required timeframe, insufficient documentation of the damage, and non-compliance with policy terms. Review your policy carefully and ensure you meet all requirements when filing your claim.

How long does the insurance claim process typically take?

Answer: The length of the insurance claim process can vary depending on the complexity of the claim and the responsiveness of the insurance company. On average, it can take anywhere from a few weeks to several months. Promptly providing thorough documentation and following up regularly with your insurance company can help expedite the process. If delays become unreasonable, consulting with an insurance lawyer may be necessary.

What if my insurance claim is denied?

Answer: If your insurance claim is denied, review the denial letter to understand the reasons given by the insurance company. Gather additional documentation to support your claim and consider filing an appeal. If you still face issues, consult with an insurance attorney to explore your options and potentially challenge the denial.

How do I estimate the value of my damaged property?

Answer: To estimate the value of your damaged property, gather receipts, purchase records, and any appraisals you have. Use current market values for similar items to help determine replacement costs. An insurance adjuster will also provide an assessment, but having your own estimate can be useful for comparison and negotiation.

Can I choose my own contractor for repairs?

Answer: Yes, you generally have the right to choose your own contractor for repairs. However, it’s important to ensure that your insurance company approves the contractor and the repair estimate to avoid any payment issues. Get multiple quotes to ensure you are getting a fair price for the work.

What types of documentation are crucial for a successful insurance claim?

Answer: Crucial documentation includes detailed photographs and videos of the damage, written descriptions of the incident and extent of the damage, an inventory list of damaged items with their values, receipts for temporary repairs, maintenance records, and copies of all communications with your insurance company.

How can I avoid common pitfalls when filing an insurance claim?

Answer: To avoid common pitfalls, thoroughly understand your policy and coverage limits, file your claim promptly, provide comprehensive and accurate documentation, follow the insurance company’s procedures, keep records of all interactions, and seek professional advice if you encounter any issues. Being proactive and organized can significantly improve the outcome of your claim.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998