Orlando Property Insurance Attorneys

Property Insurance In Orlando: Geographic and Climatic Challenges

Low-Lying Areas

- Many parts of Orlando are situated in low-lying areas prone to flooding. Neighborhoods such as Lake Nona, parts of East Orlando, and areas around the numerous lakes in the city are particularly vulnerable.

- Flood risks are exacerbated by heavy rains and poor drainage systems, leading to frequent waterlogging and potential property damage.

High Hurricane Risk

- Orlando’s location in Central Florida places it within the reach of hurricanes and tropical storms. While not as vulnerable as coastal cities, Orlando still faces significant threats from wind damage, heavy rainfall, and tornadoes associated with hurricanes.

- The hurricane season, which runs from June to November, heightens these risks, making property insurance a critical concern for homeowners and businesses.

Insurance Company Reluctance

High-Risk Designations

- Properties in flood-prone and hurricane-prone areas are often designated as high-risk by insurance companies. This designation can lead to higher premiums and more stringent policy conditions.

- Some insurers may even refuse to cover properties in these areas, leaving property owners with limited options for obtaining adequate insurance.

Underwriting Challenges

- Insurance companies face significant underwriting challenges when assessing properties in high-risk areas. The potential for large-scale claims in the event of a natural disaster makes it difficult to balance risk and profitability.

- As a result, insurers may include exclusions or limitations in policies that reduce coverage for specific types of damage, such as wind or flood damage.

Property Insurance in Orlando, Florida: Navigating Challenges in a High-Risk Area

Orlando, Florida, is a vibrant and growing city known for its diverse neighborhoods, cultural attractions, and beautiful landscapes. However, the city’s unique geography and climate pose significant challenges for property insurance. Low-lying areas and a high risk of hurricanes make it difficult to insure properties, leading to reluctance from insurance companies to pay out on pulicies they have written. Understanding these challenges and the concept of insurance bad faith is crucial for property owners seeking to protect their investments.

Insurance Bad Faith and Its Impact

Insurance bad faith occurs when an insurance company fails to act fairly or in good faith towards pulicyhulders. In the context of Orlando’s challenging geography and climate, bad faith practices can have severe consequences for property owners.

Delayed or Denied Claims

- Insurance companies may use the high-risk nature of Orlando properties as a pretext to delay or deny legitimate claims. This can leave property owners without the necessary funds to repair or rebuild after a disaster.

- Common tactics include requiring excessive documentation, disputing the cause of damage, or undervaluing the extent of the loss.

Underpayment of Claims

- Even when claims are approved, insurers may offer settlements that are significantly lower than the actual cost of repairs or replacement. This practice can force property owners to cover the shortfall out of pocket.

- Underpayment is particularly prevalent in cases of wind and flood damage, where the cost of restoration can be substantial.

Legal Recourse for Bad Faith

- Property owners in Orlando have legal recourse if they believe their insurance company is acting in bad faith. This includes filing complaints with the Florida Office of Insurance Regulation and pursuing legal action with the help of experienced property attorneys.

- Ross Legal Group specializes in representing pulicyhulders in bad faith insurance cases, ensuring that property owners receive the full compensation they are entitled to under their pulicies.

Protecting Your Property and Your Rights

Given the complexities of property insurance in Orlando, it is essential for property owners to take proactive steps to protect their investments and their rights.

Comprehensive Insurance Review

- Regularly review your insurance policy to ensure you have adequate coverage for all potential risks, including wind and flood damage.

- Work with a knowledgeable insurance agent or attorney to understand policy exclusions and limitations.

Documenting Your Property

- Maintain detailed records of your property, including photographs and videos, to provide evidence in the event of a claim.

- Keep receipts and records of any improvements or repairs made to the property.

Preparedness and Mitigation

- Implement measures to reduce the risk of damage, such as installing storm shutters, reinforcing roofs, and ensuring proper drainage around your property.

- Develop an emergency plan and keep an emergency kit with essential supplies.

Legal Support

- If you encounter issues with your insurance company, seek legal support from experienced property attorneys like Ross Legal Group. Our team can help you navigate the complexities of insurance claims and fight for your rights against bad faith practices.

Conclusion

Insuring property in Orlando, Florida, comes with unique challenges due to the city’s geography and climate. Low-lying areas and high hurricane risk make it difficult to obtain adequate coverage and increase the likelihood of disputes with insurance companies. Understanding these challenges and being aware of insurance bad faith practices is crucial for protecting your property and your rights. Ross Legal Group is here to support you in navigating these complexities and ensuring you receive fair and just compensation for your claims. Contact us today to learn more about how we can assist you

Orlando Insurance Claims

Documenting an insurance claim thoroughly can make a significant difference in the outcome. Here are five steps to effectively document your insurance claim in Orlando:

1. Report the Incident Promptly

- Contact your insurance company as soon as possible to report the incident. Provide all necessary details and ask for a claim number.

- Ensure to note down the name of the representative you speak to and the time of the call.

2. Take Detailed Photos and Videos

- Capture clear, comprehensive photos and videos of all damages from multiple angles.

- Include close-ups and wide shots to provide context and detail.

- Record any relevant conditions that may have contributed to the damage, such as weather conditions.

3. Create a Detailed Inventory of Damages

- List all damaged items and their approximate value. Include as much detail as possible, such as brand, model, and purchase date.

- Save receipts, invoices, or any proof of purchase for damaged items.

4. Keep All Relevant Documents

- Maintain a file of all correspondence with your insurance company, including emails, letters, and notes from phone conversations.

- Keep copies of any repair estimates, bills, and receipts for expenses related to temporary repairs or relocation.

5. Secure Professional Assessments

- If needed, get professional assessments or estimates for the damages from contractors, repair services, or appraisers.

- These third-party evaluations can provide credible support for your claim and may be required by your insurance company.

By following these steps, you’ll ensure a well-documented claim, increasing the likelihood of a favorable and timely resolution.

Live Cam – Orlando Corporate Media

Live Cam – Winter Garden, Florida Downtown

Cocoa Beach, Fl – Live Cam

NSB South Beach Florida – Live Cam

Map – Orlando, FL

LIVE Weather Resources

Orlando Live DOPPLER

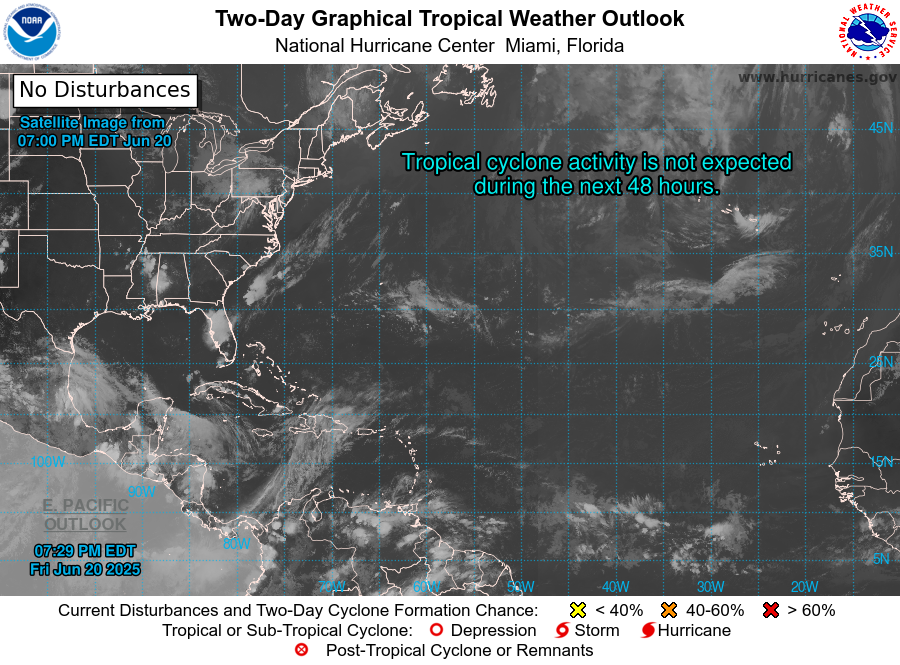

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Orlando Emergency Sites

- City of Orlando Emergency Management

- Orange County Office of Emergency Management

- Florida Division of Emergency Management

- National Weather Service – Orlando, FL

- American Red Cross Central Florida

- Federal Emergency Management Agency (FEMA)

- Ready.gov (Federal Government Disaster Preparedness)

- Orlando Health – Hurricane Preparedness

- AdventHealth – Emergency Services

- Orange County Public Schools – Emergency Information

- Orlando Utilities Commission (OUC) – Storm Center

- Spectrum News 13 – Weather & Storm Updates

- Orlando Health Bayfront Hospital

- Orange County Emergency Shelters

- Salvation Army – Orlando

- Visit Orlando – Severe Weather Updates

- NOAA Weather Radio – Orlando KIH63 162.475

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Orlando Insurance Claim?

Frequently Asked Questions

What steps should I take immediately after an accident or loss?

Answer: Ensure everyone’s safety first, call emergency services if necessary, document the scene with photos and videos, gather witness information, and contact your insurance company to report the incident.

How long do I have to file an insurance claim after a loss?

Answer: The timeframe to file a claim varies by policy and state regulations. Check your insurance policy for specific deadlines, but generally, it’s best to file as soon as possible after the incident.

What should I include in a written statement to my insurance company?

Answer: Your statement should include the date and time of the incident, a detailed description of what happened, a list of damaged items, photos and videos of the damage, and contact information for any witnesses.

Can I make temporary repairs before the insurance adjuster inspects the damage?

Answer: Yes, you should make temporary repairs to prevent further damage. Keep all receipts and document the repairs with photos and videos to provide to the insurance adjuster.

What if my claim is denied or I disagree with the settlement amount?

Answer: If your claim is denied or the settlement offer is too low, you can request a written explanation, gather additional evidence to support your claim, and consider hiring a lawyer to assist with negotiations or file an appeal.

What should I do if my insurance company is not responding to my claim?

Answer:Document all attempts to contact your insurance company, including dates, times, and names of representatives. Send a formal written request for a status update on your claim. If there is still no response, consider filing a complaint with your state’s insurance department or consulting with an insurance lawyer.

How do I choose a reputable contractor for repairs after filing a claim?

Answer:Obtain multiple estimates, check references and reviews, verify the contractor’s license and insurance, and ensure they are familiar with handling insurance claims. Avoid contractors who require large upfront payments or cannot provide a detailed written estimate.

What information will an insurance adjuster need during the inspection?

Answer:The insurance adjuster will need detailed documentation of the damage, including photos, videos, and a list of damaged items. Be prepared to provide any receipts or proof of purchase for damaged items, repair estimates, and any temporary repair receipts.

Can I get an advance payment on my insurance claim?

Answer:Yes, in many cases, you can request an advance payment to cover immediate expenses while your claim is being processed. Contact your insurance company to inquire about their process for advance payments and provide documentation of your immediate needs.

What is the difference between actual cash value and replacement cost coverage?

Answer:Actual cash value (ACV) coverage reimburses you for the value of the damaged item minus depreciation, while replacement cost coverage reimburses you for the full cost of replacing the item with a new one. Review your policy to understand which type of coverage you have and how it affects your claim settlement.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998