Pensacola Property Insurance Attorneys

Property Insurance In Pensacola: Geographic and Climatic Challenges

Pensacola’s location along the Gulf Coast exposes it to severe weather conditions, including hurricanes, tropical storms, and heavy rainfall. The combination of these factors makes property insurance a critical yet complex issue.

- Low-Lying Areas

- Many parts of Pensacola are at or near sea level, increasing the risk of flooding.

- Properties in low-lying areas are particularly vulnerable to storm surge and heavy rainfall, leading to frequent and severe flood damage.

- High Hurricane Risk

- Pensacola is in a region prone to hurricanes, which bring high winds, torrential rains, and storm surges.

- The hurricane season, from June to November, poses a constant threat to property owners, necessitating comprehensive insurance coverage.

Insurance Companies’ Reluctance to Pay Out

Given the high risk associated with insuring properties in Pensacola, insurance companies often adopt a conservative approach when it comes to paying out claims. This reluctance can manifest in various ways:

- Claim Denials: Insurance companies may deny claims based on technicalities or exclusions in the policy.

- Underpayment: Insurers may offer settlements that are significantly lower than the actual cost of repairs.

- Delays: Prolonged processing times for claims can leave homeowners in a difficult position.

Property Insurance in Pensacola, Florida: Navigating Challenges in a High-Risk Area

Pensacola, Florida, with its picturesque coastline and vibrant community, is an attractive place to live and own property. However, the unique geography and climate of the area pose significant challenges for property insurance. Low-lying areas and a high risk of hurricanes make it difficult to secure adequate insurance coverage, and insurance companies are often reluctant to pay out on the policies they have written. This reluctance can lead to instances of insurance bad faith, further complicating the situation for homeowners.

Insurance Bad Faith and Its Impact

Given the high risk associated with insuring properties in Pensacola, insurance companies face significant challenges, often resulting in reluctance to provide coverage or pay out claims.

- Difficulty in Securing Coverage

- Due to the high risk of flooding and hurricane damage, insurance premiums in Pensacola are typically higher than in less vulnerable areas.

- Some insurance companies may decline to offer coverage altogether for properties in high-risk areas.

- Reluctance to Pay Out Claims

- When a claim is filed, insurance companies may delay, undervalue, or outright deny the claim.

- This reluctance is often driven by the high cost associated with frequent and severe weather-related claims.

- Insurance Bad Faith

- Insurance bad faith occurs when an insurer fails to honor the terms of the policy without a valid reason.

- In Pensacola, the compounded risks of geography and climate increase the likelihood of bad faith practices by insurers.

Protecting Your Rights as a Policyholder

To navigate the complexities of property insurance in Pensacola, it’s essential to understand your rights and take proactive steps to protect them.

1. Understand Your Policy

- Thoroughly review your insurance policy to know what is covered and any exclusions that may apply.

- Pay special attention to provisions related to flood and wind damage.

2.Document Everything

- Keep detailed records of all communications with your insurance company, including emails, phone calls, and letters.

- Document the condition of your property before and after any damage with photographs and videos.

3.File Claims Promptly

- Report any damage and file your claim as soon as possible to ensure timely processing.

4.Seek Legal Assistance

- Consult with an experienced property attorney, like Ross Legal, to help navigate the claims process and address any issues of bad faith.

Conclusion

Property insurance in Pensacola, Florida, is fraught with challenges due to the area’s geography and climate. Low-lying areas and high hurricane risk make it difficult to secure adequate coverage and often lead to reluctance from insurance companies to pay out claims. Understanding your rights and seeking professional legal assistance can help protect you from insurance bad faith practices and ensure you receive the compensation you deserve.

Pensacola Insurance Claims

Documenting an insurance claim thoroughly can make a significant difference in the outcome. Here are five steps to effectively document your insurance claim in Pensacola:

1. Immediate Safety and Damage Assessment

- Safety First: Ensure everyone’s safety and secure the property if necessary.

- Initial Assessment: Take note of the extent of the damage. Identify areas needing immediate attention.

2. Detailed Photo and Video Documentation

- Photographs: Capture wide-angle shots of the entire affected area and close-ups of specific damages.

- Videos: Record detailed walkthroughs of the damaged areas, narrating what you see for clarity.

3. Written Inventory and Description

- Itemize Damages: Create a detailed list of all damaged items, including their description, quantity, and condition.

- Descriptions: Provide a brief description of the damage to each item or area, noting any pre-existing conditions.

4. Gather Supporting Documents

- Receipts and Warranties: Collect receipts, warranties, and any previous appraisals for damaged items.

- Maintenance Records: Include any records of maintenance or repairs done to the property before the damage occurred.

4. Professional Assessments

- Contractor Estimates: Obtain written estimates for repairs from licensed contractors.

- Independent Appraisals: Consider hiring an independent appraiser to provide an unbiased assessment of the damage and repair costs.

Tips for Successful Claim Documentation

- Organize Chronologically: Keep your documentation organized in the order events occurred.

- Back-Up Copies: Make digital copies of all documentation to prevent loss or damage.

- Communication Logs: Maintain a log of all communications with your insurance company, including dates, times, and the names of representatives you spoke with.

- Claim Number: Always reference your claim number in communications and documentation.

Properly documenting your claim can significantly impact the efficiency and success of your insurance claim process. If you need assistance or encounter difficulties, consider consulting with a professional insurance attorney to ensure your rights are protected and you receive fair compensation.

Beachhouse Webcam Miramar Beach, FL

Pensacola Beach, Florida

Pensacola Lighthouse, Florida

Pensacola, Florida

Map – Pensacola, FL

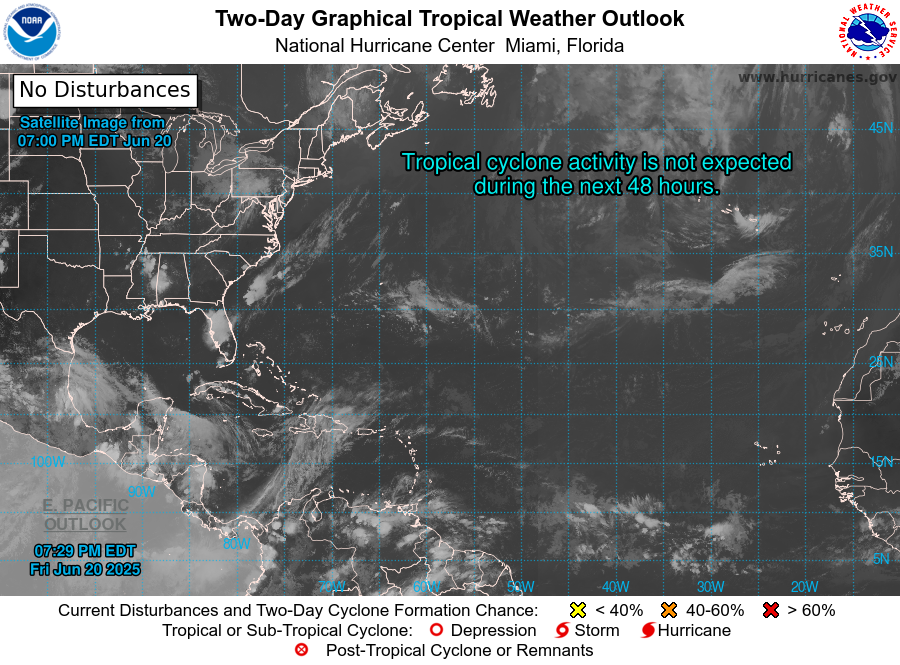

LIVE Weather Resources

Pensacola Live DOPPLER

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Pensacola Emergency Sites

- City of Pensacola Emergency Management

- Escambia County Emergency Management

- Florida Division of Emergency Management

- National Weather Service Mobile/Pensacola

- American Red Cross of Northwest Florida

- Ready.gov Disasters and Emergencies

- Federal Emergency Management Agency (FEMA)

- Pensacola News Journal Storm Center

- Gulf Power Company Storm Center

- Escambia County Sheriff’s Office

- Pensacola Fire Department Emergency Preparedness

- Escambia County Emergency Management – BeReady

- City of Pensacola Emergency Preparedness

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Pensacola Insurance Claim?

Frequently Asked Questions

What should I do if my insurance claim is denied?

Answer: Review the denial letter to understand the reasons, gather additional documentation to support your claim, and consider appealing the decision. If necessary, consult with an insurance lawyer to explore your options for challenging the denial.

How long does the insurance claim process take?

Answer: The duration varies depending on the complexity of the claim and the insurance company’s procedures. Generally, straightforward claims can be resolved within a few weeks, while more complex claims may take several months. Regularly follow up with your insurance company to stay informed about the status of your claim.

What temporary repairs can I make after wind or hurricane damage?

Answer: You can make temporary repairs to prevent further damage, such as covering broken windows with plywood, using tarps to cover roof damage, and removing water to prevent mold. Keep receipts for any materials purchased and document the repairs with photos.

Can I choose my own contractor for repairs?

Answer: Yes, you can choose your own contractor, but it’s advisable to select one who is licensed and insured. Provide your insurance company with the contractor’s estimates and ensure that all repairs meet the insurance company’s requirements.

What should I include in my insurance claim documentation?

Answer: Your documentation should include photos and videos of the damage, a detailed inventory of damaged items, receipts and maintenance records, contractor estimates, and any communication logs with the insurance company. This comprehensive documentation helps substantiate your claim and can expedite the process.

What is the difference between actual cash value and replacement cost in an insurance policy?

Answer: Actual cash value (ACV) refers to the value of your property at the time of loss, accounting for depreciation. Replacement cost covers the cost of replacing the damaged property with new items of similar kind and quality without deduction for depreciation. Review your policy to understand which type of coverage you have.

How can I speed up the insurance claim process?

Answer: To expedite the process, ensure all required documents are submitted promptly, respond quickly to any requests from your insurance company, maintain organized and thorough documentation, and keep open communication with your insurance adjuster. Hiring a public adjuster or lawyer can also help streamline the process.

What should I do if I disagree with the insurance adjuster’s assessment?

Answer: If you disagree with the assessment, gather additional evidence to support your position, such as independent contractor estimates or appraisals. You can request a re-evaluation from your insurance company or consider hiring a public adjuster or insurance lawyer to negotiate on your behalf.

Are there any deadlines for filing an insurance claim?

Answer: Yes, insurance policies typically have deadlines for filing claims, which can vary by company and policy type. It’s crucial to review your policy for specific time limits and file your claim as soon as possible after the damage occurs to avoid any issues with coverage.

What is an insurance appraisal clause, and when should I use it?

Answer: An insurance appraisal clause is a provision in many insurance policies that allows for a third-party appraisal to resolve disputes over the amount of a loss. It involves hiring independent appraisers and an umpire to determine the value of the claim. Use this clause if you and your insurance company cannot agree on the amount of the loss and want a neutral evaluation.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998