Tampa Property Insurance Attorneys

Property Insurance In Tampa: Geographic and Climatic Challenges

- Low-Lying Areas: Tampa is characterized by numerous low-lying areas, making it susceptible to flooding. This geographical feature significantly impacts property insurance.

- Elevated Insurance Premiums: Insurers account for the increased risk by raising premiums, making property insurance more expensive for homeowners.

- Strict Underwriting Standards: Insurance companies impose strict underwriting standards to mitigate their risk, often requiring additional flood insurance, which can be costly.

- High Hurricane Risk: Tampa is located in a region prone to hurricanes, which further complicates the property insurance landscape.

- Frequent Claims: The frequency and severity of hurricanes result in numerous claims, putting a strain on insurance companies’ resources.

- Comprehensive Coverage Requirements: Homeowners need comprehensive coverage that includes windstorm and flood insurance, adding to the overall cost of insuring a property.

- Potential for Catastrophic Losses: Insurers face the possibility of catastrophic losses during major hurricanes, which can lead to financial instability within the industry.

Property Insurance in Tampa, Florida: Navigating Challenges in a High-Risk Area

Property insurance in Tampa, Florida, presents unique challenges due to the region’s geography and climate. Tampa’s low-lying areas and high hurricane risk make insuring properties difficult and often result in insurance companies being reluctant to pay out on the policies they have written. This reluctance can lead to instances of insurance bad faith, compounding the difficulties faced by property

Insurance Companies’ Reluctance to Pay Out

Given the high risk associated with insuring properties in Tampa, insurance companies often exhibit reluctance to pay out on the policies they have written. This reluctance manifests in several ways:

- Denial of Claims: Insurers may deny claims based on technicalities or policy exclusions, leaving homeowners without the financial support they need to repair or rebuild their properties.

- Delayed Payments: Insurance companies might delay payments, causing financial strain on policyholders who need immediate funds for repairs.

- Underpayment of Claims: Insurers might undervalue the damage, resulting in insufficient payouts that do not cover the full extent of the loss.

Insurance Bad Faith Risks

The reluctance of insurance companies to pay out on claims can lead to instances of insurance bad faith. This occurs when an insurer fails to uphold its contractual obligations to its policyholders. In Tampa, the risk of insurance bad faith is heightened by the region’s unique challenges:

- Disputed Claims: Policyholders often find themselves in disputes with insurers over coverage limits, exclusions, and the extent of damage.

- Legal Battles: Homeowners may need to engage in legal battles to receive the compensation they are entitled to, further complicating an already stressful situation.

- Regulatory Scrutiny: The high incidence of disputed claims and insurance bad faith cases can attract regulatory scrutiny, leading to stricter regulations and oversight within the industry.

Legal Support for Property Owners

Given the complexities of property insurance in Tampa, having legal support is crucial for homeowners. A property attorney, like Ross Legal in Tampa, can provide invaluable assistance in navigating the intricacies of insurance policies and advocating for policyholders’ rights. Services offered by property attorneys include:

- Policy Review: Ensuring that homeowners understand their coverage and the limitations of their insurance policies.

- Claims Assistance: Guiding policyholders through the claims process to maximize their chances of receiving fair compensation.

- Bad Faith Litigation: Representing homeowners in cases of insurance bad faith, helping them to obtain the compensation they deserve.

Conclusion

Property insurance in Tampa, Florida, is fraught with challenges due to the area’s geography and climate. The high risk of flooding and hurricanes makes it difficult to insure properties, leading to increased premiums and stringent underwriting standards. Insurance companies’ reluctance to pay out on claims exacerbates these difficulties, resulting in potential instances of insurance bad faith. For homeowners, having legal support from a property attorney like Ross Legal is essential to navigate these challenges and ensure they receive the coverage and compensation they need.

Tampa Insurance Claims

University Of Tampa – Live Video

Clearwater Beach – Live Video

Clearwater Beach – Florida Live cam

Beach of Clearwater – Florida Live cam

Map – Tampa, FL

LIVE Weather Resources

Tampa Live DOPPLER

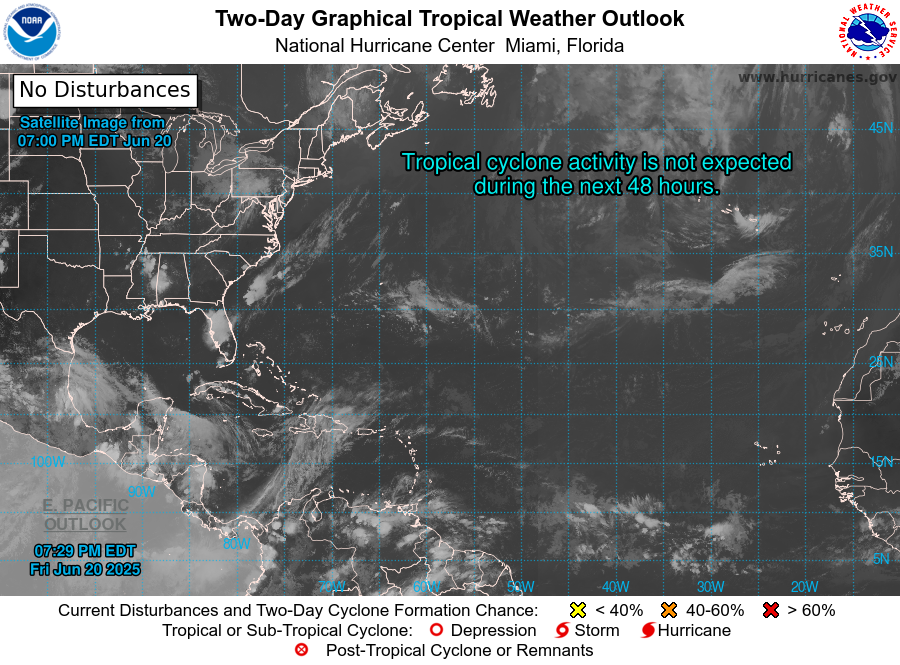

Two Day NOAA Tropical Outlook

SE USA Satellite GOES Radar

SE USA Full Spectrum

Atlantic Basin GOES Satellite

Tampa Emergency Sites

- City of Tampa Emergency Management

- Hillsborough County Emergency Management

- Florida Division of Emergency Management

- National Hurricane Center (NHC)

- Tampa Bay Regional Planning Council – Storm Tools

- American Red Cross Central Florida

- Federal Emergency Management Agency (FEMA)

- Florida Office of Insurance Regulation (OIR)

- National Flood Insurance Program (NFIP)

- Insurance Information Institute (III)

Florida Gov & County Resources

- Florida Division of Emergency Management (FDEM)

- National Hurricane Center

- Florida Disaster Fund

- FEMA Federal Emergency Management Agency

- Florida Special Needs Registry

- Florida 511 Traffic Information

- GasBuddy (for fuel availability)

- Ready.gov Hurricane Preparedness

- American Red Cross Shelter Finder

- VISIT FLORIDA Weather Updates

- Florida Office of Financial Regulation Hurricane Resources

- Florida Restaurant and Lodging Association (FRLA) Hurricane Resources

- Florida Department of Environmental Protection Hurricane Information

- Florida Behavioral Health Association Hurricane Resource Center

- Heart of Florida United Way Hurricane Resources

Tampa Insurance Claim?

Frequently Asked Questions

What steps should I take to prepare my home for a hurricane?

Answer: To prepare your home for a hurricane, secure windows and doors with shutters or plywood, bring in outdoor furniture, trim trees and shrubs, secure loose items, and reinforce your garage door. Ensure your emergency kit is ready and have a family evacuation plan.

How do I choose the right insurance coverage for hurricane damage?

Answer: Evaluate your needs and risks, compare policies from different insurers, and ensure your policy covers wind, flood, and storm surge damage. Consider additional riders if necessary and consult with an insurance agent to find the best coverage for your situation.

What are common mistakes to avoid when filing a hurricane insurance claim?

Answer: Avoid mistakes such as delaying the filing of your claim, not documenting all damages thoroughly, making permanent repairs before the adjuster inspects, not keeping receipts for temporary repairs, and accepting a low initial settlement offer without negotiation.

How can I ensure my insurance claim is processed smoothly?

Answer: Ensure your claim is processed smoothly by providing detailed documentation, including photos and videos of the damage, an itemized list of lost or damaged items, and repair estimates. Stay organized, keep communication records, and follow up regularly with your insurer.

What can I do if my insurance settlement is too low?

Answer: If your insurance settlement is too low, review the offer in detail, gather additional evidence of your losses, and negotiate with your insurer. You can also seek a second opinion from a public adjuster or consult with an insurance lawyer to advocate for a fair settlement.

What should I include in my hurricane emergency kit?

Answer: Your hurricane emergency kit should include essential items such as non-perishable food, water, medications, a first aid kit, flashlights, batteries, important documents, cash, and personal hygiene items.

How soon should I contact my insurance company after a hurricane?

Answer: Contact your insurance company as soon as possible after ensuring safety and documenting the damage. Prompt notification helps expedite the claims process and ensures timely assistance.

Can I stay in my home while it’s being repaired after a hurricane?

Answer: It depends on the extent of the damage. If your home is safe and livable, you may stay. However, if there are structural damages or safety hazards, it’s best to seek temporary accommodation until repairs are completed.

What should I do if my insurance claim is denied?

Answer: If your insurance claim is denied, review the denial letter and your policy to understand the reasons. Gather additional evidence and documentation to support your claim, and consider consulting with an insurance lawyer to explore further options.

How can I speed up the insurance claim process after a hurricane?

Answer: To expedite your insurance claim, ensure all documentation is thorough and submitted promptly. Stay in regular contact with your insurance adjuster, promptly respond to any requests for additional information, and consider hiring a public adjuster or attorney if necessary.

Don’t Get Bullied By Your Insurance Company

Prove your claim - Get fair treatment - Assert your rights in Court

We have fought for policyholder interests against hundreds of large insurance companies including these:

ROSS LEGAL GROUP

1800 Second Street Suite 765 – Sarasota, FL – 34236

Call Now : 941-275-1998